Overview

With the news buzzing with inflation, interest rates, layoffs, hiring freezes, and a possible recession, NPE filing activity increased 14.8% this quarter with 656 total district court filings this quarter versus 525 filings last quarter. In addition, as the USPTO Director Kathi Vidal begins to tackle Fintiv and provide guidance on it, reexaminations have dropped 25.8% since last year, to levels akin to those of 5 years ago. NPEs continue to target high-tech companies with patents related to data processing, database management, payment authorization, distributed node communication, wireless protocols, terminal devices, indexing and web crawling.

Highlights:

At the current rate of filing, district court litigation is projected to be down 3.8%, PTAB will increase 4.3%, and Ex Parte Reexaminations down 25.8% in FY2022.

One cause of the decline in the district court is the fact that Operating Company litigation is down, with 622 cases, a 13.7% decrease, versus the first half of 2021 of 721. NPE (PAE) activity increased 16% with 481 cases this quarter versus 404 in Q1 2022. This could be a function of reduced capital or market strains on corporate bottom lines, or it could just be noise–-drops and jumps of this magnitude are common over the years.

The Texas Western District (led almost entirely by the Waco division), with 389 NPE cases, accounts for 21.1% of all patent litigation in the US in H1 2022.

IP Edge had 321 unique entities accounting for 233 assertions, or nearly 21.5% of all NPE (PAE) assertions in H1 2022. Cedar Lane alone brought 82 assertions.

With its 5G FRAND war ongoing with Apple, Ericsson continues to be the top patent owner filed against, entirely based on that sprawling dispute. The remaining 9 of the top 10 entities are all aggressive NPEs.

Figure 1: Continuing in Q2 of 2022, patent disputes are remaining flat versus last quarter. At the current rate of filing, district court litigation is projected to be down 3.8%, PTAB will increase 4.3%, and Ex Parte Reexaminations 25.8% in FY2022.

Figure 2: NPE asserted 654 times in district court, which increased 14.8%versus Q1 of 2022 with 525. Operating Company litigation is down with 641 cases, a 11.1% decrease, versus the first half of 2021 of 721.

Figure 3: NPEs that aggregate patents (PAEs) activity increase 19% this quarter, with 481 district court filings this quarter, compared to 404 last quarter.

Figure 4: The Texas Western District Court with 389 NPE cases accounts for 21.1% of patent litigation in the US in H1 2022. The Texas Western District Court NPE litigation outpaced the Delaware District Court filings by 30 with only 369.

Figure 5: NPEs prefer the Western District of Texas 33.1% of the time, with nearly 82% of all cases in that district NPE related.

Figure 6: High-Tech litigation continues to dominate both district courts and the PTAB.

District Court

Figure 7: On the surface, while there may be a decline in the overall numbers, NPEs are still responsible for bringing suit 64% of time when compared to 2021.

Figure 8: Cedar Lane was one of the top asserting entities in H1 2022. There were four IP Edge entities in the top 10 asserting entities in H1 2022. They combined for a total of 48 cases.

Figure 9: IP Edge had 31 unique entities accounting for 233 assertions, nearly 19.5% of all NPE (PAE) assertions in H1 2022.

Figure 10: High-tech companies populated the list of first named defendants. Zydus Pharmaceuticals is the only exception among the top 10 defendants.

Figure 11: Over 71% of all district court litigation in H1 2022 was related to the high-tech sector.

Figure 12: 95% of NPE litigation targets were high-tech companies in H1 2022, while only 27% of Non-NPE litigation targets were high-tech companies.

Figure 13: Over 85% of high-tech litigation is brought by an NPE.

Figure 14: The most targeted CPCs by NPE litigation are data processing, database management, payment authorization, distributed node communication, wireless protocols, terminal devices, indexing and web crawling.

PTAB Disputes

Figure 15: Despite the drop in projected filings, NPE related filings will increase by 14.8%.

Figure 16: PTAB Q2 2022 petitions totaled 350.

Figure 17: Consistent with district court proceedings, approximately 67.7% of all PTAB petitions filed in Q1 2022 involved High-Tech companies.

Figure 18: Approximately 54% of all AIA challenges filed in H1 2022 involved High-Tech companies petitioning NPE-controlled patents. Explore this data further on Unified’s Portal.

Figure 19: IPRs remained the most popular post-grant proceeding at the PTAB claiming 89.0% of all PTAB petitions. Reexaminations were the second most popular, accounting for nearly 8.4% of all patent challenges at the USPTO. Explore this data further on Unified’s Portal.

Figure 20: Collectively, Apple, Samsung, and Google accounted for 31.3% (215) of all petitions at the PTAB. Unified Patents was 4th in total petitions in H1 2022.

Figure 21: It is no surprise that 9 out of the top 10 patent owners at the PTAB are NPEs. As noted before, the IPR petitions against Ericsson's patents were filed by Apple in its ongoing FRAND battle.

Figure 22: Reexams are projected to drop by 15.7% during 2022 based on H1 2022. However, this number is still 52% higher than recent lows in 2017-2019 when the average was 176. It should be noted that Unified Patent is 6th overall in reexamination filings with 25.

Figure 22: One reason Reexams could be declining is the fact that the Kathi Vidal has made several changes around the Fintiv framework and as Q1 2022, Fintiv was used 3 times with a total of 10 314(a) denials for the entire quarter.

Standard Essential Patents

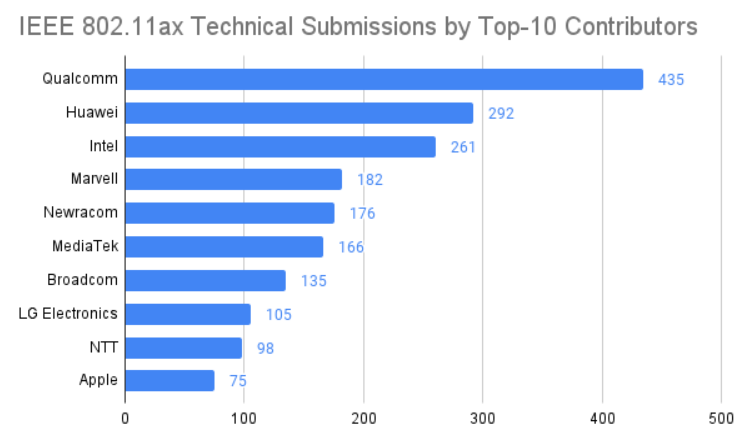

Figure 24: As Wi-Fi 6 begins to take shape, a new landscape in Portal will unveil the historic problem of IEEE of blanket declarations that often include no patents. Qualcomm leads in Wi-Fi 6 related patents that have been granted.

Figure 25: Qualcomm leading in patent grants comes as no surprise as they consistently lead in technical submissions. According to OPEN, Unified Patents’ IEEE standards submissions database, over 7,182 technical contributions have been submitted. These top 10 account for 27% of all technical contributions.

Definitions

Sectors

High-Tech = Technologies relating to Software, Hardware, and Networking

Medical = Technologies relating to Pharmaceuticals, Medical Devices, Health Related Technologies

Other = Technologies relating to Mechanical, Packaged Goods, Sporting Equipment and any other area outside of high-tech and medical patents.

Entities

Non Practicing Entity (NPE) = Company which derives the majority of its total revenue from Patent Licensing activities.

Operating Company or Op. Co. = Company which derives most of its total revenue from Product Sales or Services. Could be an SME or a large company.

Other Entity = Universities / Non-Profits / Government / Non-Governmental Organizations (NGOs)

NPE (Patent Assertion Entities) = Entity whose primary activity is licensing patents and acquired most of its patents from another entity

NPE (Small Company) = Entity whose original activity was providing products and services, but now is primarily focused on monetizing its own patent portfolio.

NPE (Individual) = Entity owned or controlled by an individual inventor who is primarily focused on monetizing inventions patents by that individual inventor.

Venues

CACD = Central District of California

CAND = Northern District of California

DED = Delaware

NJD = New Jersey

NDIL = Northern District of Illinois

SDNY = Southern District of New York

TXED = Eastern District of Texas

TXWD = Western District of Texas

Methodology

This report includes all District Court and PTAB litigations between January 1, 2015 and June 30, 2022 .

Total number of reported cases can vary based on what is included. Unified made its best attempt to eliminate mistaken, duplicative, or changes in venue filings, hence the totals may vary slightly compared to other reporting entities. Statistics include litigations initiated by NPEs or Declaratory Judgments (DJs) initiated by operating companies against NPEs.

Unified strives to accurately identify NPEs through all available means, such as court filings, public documents, and product documentation.

Copyright © 2022, Unified Patents, LLC. All rights reserved.