With multiple uncertainties in the air, including the Advance Notice of Proposed Rulemaking (ANPRM) for potential PTAB reforms, the Patent Eligibility Restoration Act of 2023, third-party funding disclosures, jury damages higher than before, and multiple FRAND decisions, patent litigation has entered a bear market. Delaware went from the number two patent venue, to number three.

Highlights:

2023 is still projected to be down for District Court by nearly 12.4%, the PTAB down by 10.7%, and Re-examinations down by 44%.

Despite the significant lack of Litigation Investment Entities (LIEs) filings, overall filings for Q2 2023 versus Q1 2023 are up 6.7% with the biggest contributor being NPE (PAE) outside of LIEs.

The Western District of Texas continued to be the most popular venue in 2023, with Delaware sliding in third place behind the Eastern District of Texas with the disclosure requirements.

NPEs account for 38% of patent owners facing ex parte reexaminations.

Recent FRAND-related decisions (Interdigital v. Lenovo and Optis v. Apple) make core WiFi 6 technologies (especially those that overlap with LTE and 5G standards) ripe for increased assertions.

Figure 1: 2023 filings are still projected to be down: in District Court by 12.4%, in the PTAB by 10.7%, and in the CRU by 44%. Notably absent from District Court is IP Edge, who accounted for almost 1,200 cases since 2020. Other high-volume LIEs such as Rothschild Entities, Acacia Research Group, Dominion Harbor, and Cedar Lane Technologies have decreased filings in 2023.

Figure 2: Despite decreased LIE filings, overall District Court filings for Q2 2023 versus Q1 2023 are up 6.7% with the biggest contributor being NPE (Patent Assertion Entities) outside of LIEs.

Figure 3: With the announcement of the Advance Notice of Proposed Rulemaking for potential PTAB reforms (ANPRM), it is no surprise that PTAB filings are down this quarter by 24%.

Figure 4: NPE (PAE)s are responsible for 54% of all suits brought in 2023.

Figure 5: The Western District of Texas continues to be the most popular venue in 2023, with Delaware sliding to third place likely due to the disclosure requirements regarding financing. However, NPEs are starting to prefer the Eastern District of Texas.

Figure 6: High-Tech litigation dominates district court and PTAB litigation in 2023.

Litigation Investment Entity Tracker (LIEs)

Figure 7: H1 2023 saw at least 25% of NPEs regardless of type where the patent asserted had been assigned to and/or funded by a LIE.

Figure 8: Jeffery Gross Entities, Intellectual Ventures, and Cedar Lane Technologies round out the top three LIEs for the first of 2023 with a combined case load of 138 or 54.3% of LIEs litigation. In comparison, 2022 saw these three entities account for 323 cases and 21.4% of LIEs litigation.

Figure 9: With court-ordered third-party financing disclosures, LIEs litigation has dropped over 83% in 2023. The most notable absence is IP Edge, with only seven filings versus its three-year average of 583+ cases.

Figure 10: Traditionally, an inverse relationship exists between the number of deals and the number of assertions - something observed in every economic downturn, with the exception of 2021. Despite GDP remaining positive the last three quarters, deals and assertions are down but still higher than pre-covid numbers.

District Court

Figure 11: NPEs account for about 50% of cases filed this quarter and are expected to be down 29% in 2023.

Figure 12: Nine out of the Top Ten asserting entities were NPEs. The only non-NPE suit is BTL Industries, a medical manufacturer with non-invasive equipment. An NPE, Web 2.0, is suing platforms such as Google Docs, Zendesk, and others over online document sharing and retention.

Figure 13: The majority of defendants are High Tech companies.

Figure 14: Nearly 58% of litigation involves the High Tech industry, while medical-related suits have increased to 16.1%.

Figure 15: NPEs targeted High Tech companies 95% of the time in 2023, while non-NPEs targeted high-tech companies only 14% of the time.

Figure 16: NPEs are still responsible for 87.4% of litigation in the High-Tech industry.

PTAB Disputes

Figure 17: PTAB filings are projected to be down by 10.7% versus last year with the ANPRM currently under comments from the public.

Figure 18: Over 71.8% of all PTAB petitions filed in 2023 involved High-Tech companies.

Figure 19: Approximately 54% of all AIA challenges filed in 2023 involved High-Tech companies petitioning NPE-controlled patents.

Figure 20: IPRs remained the most popular AIA proceeding, claiming 83.1% of all post-grant proceedings in 2023. Reexaminations were the second most popular, accounting for nearly 15.4% of all patent challenges at the USPTO. Explore this data further on Unified’s Portal.

Figure 21: High-Tech Companies such as Samsung, Google, Meta, Cisco, and Apple rounded out the list of top Petitioners this quarter.

Figure 22: While High-Tech patents are the primary focus of the PTAB, medical/pharma patents are being increasingly challenged.

Reexaminations

Figure 23: 110 Reexaminations have been filed so far in 2023, and if that trend continues, reexamination filings will be down 22% versus 2022.

Figure 24: NPEs account for 38% of patent owners challenged in reexamination.

Figure 25: Many of the most challenged patent owners in Reexaminations are NPEs.

Figure 26: Unified has been the top requester in 2023 with Apple not far behind. Unified attempted to identify the requester and when no identified party was named, the law firm became the requester.

FRAND & SEP

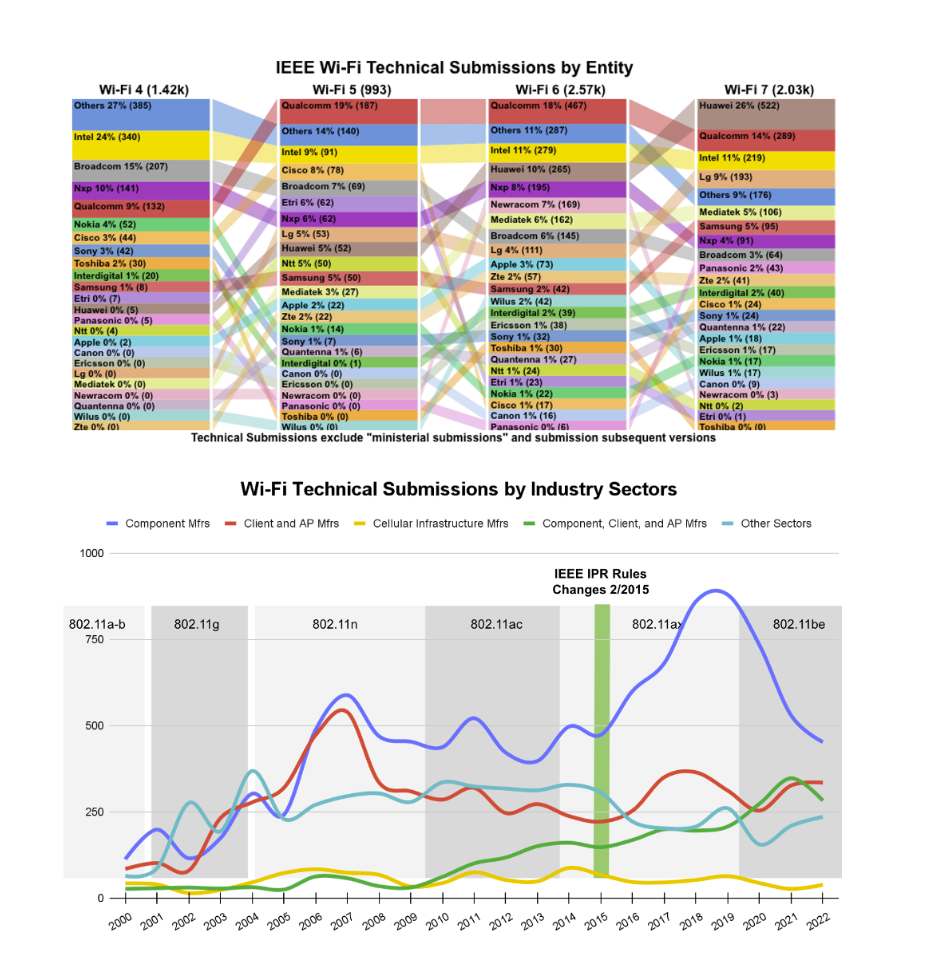

The IP Rights (IPR) rule changes adopted in October 2022 by the IEEE Board of Governors entered into effect at the start of 2023, almost eight years after controversial changes to previous IPR rules were adopted in February 2015. The new changes are patent-holder-friendly and introduce yet more uncertainty in the licensing of SEPs.

The 2015 IPR rules effectively restricted patent holders from seeking injunctions against an implementer unless patent validity and infringement had been adjudicated in favor of the patent holder on appeal. Also, under the 2015 rules, patent holders were restricted from relying on comparable patent licenses as evidence of a reasonable royalty rate if such were obtained under the explicit or implicit threat of an injunction or exclusion order. Further, a royalty rate for a patent is reasonable only if it is apportioned to the value of the relevant functionality of the smallest saleable compliant implementation that practices the patent. This was generally held to mean the smallest saleable patent practicing unit (SSPPU).

The 2023 rule changes effectively remove the ban on seeking injunctive relief against unwilling licensees. No longer must a patent holder wait to seek an injunction or exclusion order against a recalcitrant infringer until its patent has been adjudicated to be valid and infringed on appeal. The rule changes also (i) allow patent holders to rely on comparable licenses as evidence of a reasonable royalty rate even if such were obtained under the threat of an injunction or exclusion order and (ii) remove the mandatory use of the SSPPU apportionment rule in rate setting.

Figure 27:The graph below shows the effects of the 2015 IPR rule changes on Wi-Fi 6 development and innovation. The number of individual technical submissions overall grew 170% from Wi-Fi 5 to Wi-Fi 6, and the number of newly innovated (i.e., publications with a priority date after February 1, 2015) Wi-Fi 6-related publications slightly increased after the 2015 adoption of the IPR rule changes. Wi-Fi 6-related patent applications did decline slightly after the 2015 IR rule changes but remained constant through 2016, when the first draft of the Wi-Fi 6 specification was completed. As discussed in the second installment of this article, the difference between technical submissions and the decline in Wi-Fi 6-related innovation after 2016 is likely due to the adoption in Wi-Fi 6 of already-patented technologies from 3GPP such as OFDMA, MU-MIMO, and Beamforming.

Figures 28 and 29: Interestingly, the related graphs below show that participation in IEEE Wi-Fi standards development work by Wi-Fi component manufacturers such as Intel, Qualcomm, Mediatek, Broadcom, NXP, Newracom, and Quantenna increased dramatically after the 2015 IPR rule changes but participation in the same work by 3GPP infrastructure manufacturers like Ericsson, Nokia, and ZTE slightly declined. Huawei is an exception to the latter trend of the 3GPP infrastructure manufacturers as its technical submissions to Wi-Fi increased in line with the submissions by its peer Wi-Fi component, client, and AP manufacturers. The decline in technical submissions from other sectors is noticeable after the 2015 rule changes. This group comprises education and research institutions and other non-practicing entities (NPE). One takeaway from these graphs is that technical submissions sourced from Wi-Fi equipment and components manufacturers have compensated for any decline in submissions by NPEs or cellular infrastructure manufacturers.

Wi-Fi 6 shares core technologies like OFDMA, MU-MIMO, and beamforming with the LTE and 5G standards, opening itself up for more assertions from 3GPP licensors. The recent changes to the IEEE’s IPR rules introduce more uncertainty about what is permitted to be used in assessing a RAND rate and remove some of the restrictions on licensors seeking injunctions. There is concern that the greater uncertainty and expanded injunction rights will spur the current rise in U.S. Wi-Fi litigation to new heights. The concern is becoming a reality, as firms like Huawei and institutions like CalTech plead their Wi-Fi cases in court.

Definitions

Sectors

High-Tech = Technologies relating to Software, Hardware, and Networking

Medical = Technologies relating to Pharmaceuticals, Medical Devices, Health Related Technologies

Other = Technologies relating to Mechanical, Packaged Goods, Sporting Equipment and any other area outside of high-tech and medical patents.

Entities

Non Practicing Entity (NPE) = Company which derives the majority of its total revenue from Patent Licensing activities.

Operating Company or Op. Co. = Company which derives most of its total revenue from Product Sales or Services. Could be an SME or a large company.

Other Entity = Universities / Non-Profits / Government / Non-Governmental Organizations (NGOs)

NPE (Patent Assertion Entities) = Entity whose primary activity is licensing patents and acquired most of its patents from another entity

NPE (Small Company) = Entity whose original activity was providing products and services, but now is primarily focused on monetizing its own patent portfolio.

NPE (Individual) = Entity owned or controlled by an individual inventor who is primarily focused on monetizing inventions patents by that individual inventor.

NPE Aggregator = Entity that has control or ownership over two or more entities.

Litigation Investment Entities = Evidence of any third party with a financial interest, other than the assertors.

Venues

CACD = Central District of California

CAND = Northern District of California

DED = Delaware

NJD = New Jersey

NDIL = Northern District of Illinois

SDNY = Southern District of New York

TXED = Eastern District of Texas

TXWD = Western District of Texas

Methodology

This report includes all District Court and PTAB litigations between January 1, 2015 and June 30, 2023.

Total number of reported cases can vary based on what is included. Unified made its best attempt to eliminate mistaken, duplicative, or changes in venue filings, hence the totals may vary slightly compared to other reporting entities. Statistics include litigations initiated by NPEs or Declaratory Judgments (DJs) initiated by operating companies against NPEs.

Unified strives to accurately identify NPEs through all available means, such as court filings, public documents, and product documentation.

Copyright © 2023 - Unified Patents, LLC. All rights reserved.