Identifying good patents is tough. Figuring out who drafts the best applications is even harder. Unified’s Portal offers a fast approach in looking at patent prosecution success by analyzing law firms, examiners, and art units. Our current set of data consists of over 3,100 law firms in their respective art units, covers over 3 million office actions dating back to 2008, and analyzes over 1.7 million patents. Members can now compare outcomes between law firms, visualize examiner track records, or find the most prosecuted and/or successful art units in a given technology. Watch a quick video to find out more:

Top Blockchain Patent Owners and Law Firms - 2021 edition

There is not a day where the words “crypto,” “blockchain,” or “digital ledger” are used in the news or daily conversations. While some are caught up in the unstable climbs and drops of the various digital currencies, a patent war has been brewing. Some of the major financial institutions, including Goldman Sachs and Bank of America, have patented the fundamental technology that allows blockchain to reach new frontiers. In 2019 for instance, the AnnA Villa in Paris made history by becoming the first ever European property to be sold entirely via blockchain transaction for 6.5 million Euros.

As cryptocurrencies move to the forefront of the everyday financial system, major exchanges such as Coinbase, Cash App, Binance, and Bisq, that allow individuals to exchange various currencies, have seen an uptick in mergers and acquisitions. Notable, Coinbase debut on the Nasdaq in April 2021 with a 86 billion USD market value.

This comes shortly after a flurry of M&A activity in 2020. In a report published by PwC, the total market value of crypto-related deals during the first half of 2020 ($600 million) exceeded all of 2019. This is significant even when accounting for Binance’s estimated 400 million USD acquisition of CoinMarketCap in April of 2020.

Later in November 2020, PayPal made the jump into crypto offerings, putting the whole financial industry on notice. This activity has some predicting that digital financial companies, such as Square, Mastercard, Visa and also tech giants like Facebook, will set a pace for broader financial services companies in the upcoming quarters with their own investments and moves into crypto offerings.

Meanwhile, the second half of 2020 saw deals involving decentralized finance largely built on Ethereum. These factors have led to a number of new applications that mostly centered on the trading and liquidity sourcing of more thinly traded crypto currencies. The interesting part of late 2020 and early 2021 was not only the myriad of new applications, but the rise of blockchain-based Non-Fungible Tokens (NFT) which saw celebrities and even famous investors create their own tokens.

The highest-value NFT sale to date is a piece by crypto-artist Beeple put on auction at Christie's. It was the first NFT to be sold at the historic auction house and pointed to a newfound institutional legitimacy for the burgeoning market. The art piece, titled "Everydays: The First 5000 Days," was a compilation of 5,000 pieces by Beeple. The token sold for 69 million USD.

Not only did the concept of NFTs launch, but it spurred a new social media network launch just a few months ago called BitClout. This platform allows people to buy or sell non-fungible tokens to an automated market maker; the tokens are called "creator coins" and are bound to cryptographically secured accounts with unique names.

While the focus has been in the financial sector, the reach of Blockhain’s disruption is not an isolated event. It has the potential to affect every industry including 5G. For example, vehicles will be utilizing the Vehicle-to-Everything system (V2X). The V2X system will need hundreds of key-paired certificates weekly, which a blockchain would be able to provide.

With all the recent activity, Unified Patents decided to look at the landscape to determine, in the US, who were the top patent holders and how companies could use various metrics to examine both their patent portfolio but also their choice of a patent prosecution firm to bolster their position in the blockchain market.

Using the keywords identified below in the appendix, the search resulted in 1,965 patent families, which included 5,985 patents or patent applications. Of that 1,969 were from the US. China followed in second with 1,417. WO applications encompassed 737, EPO had 444, while Korea had 226. The geographical breakdown can be seen below.

Regarding US patents, Unified found the top five patent holders to be Qomplx, Advanced New Technologies, IBM, Walmart, and Accenture. The top 20 holders can be seen below.

Using Unified Portfolio Value Index (PVIX), for the top-20 patent holders an interesting trend emerged. The range of scores are between 43 and 65, meaning that there is no clear leader yet in terms of value. Looking at the standard deviation, 3 companies manage to fall outside of the first deviation, Accenture, Ping Identity Corp, and Mastercard. This would indicate that Accenture, Ping Identity Corp, and Mastercard portfolios in this space have a greater value.

Accenture had the highest PVIX score. One of its highest scoring patent families includes US Patent No. 10063529, which was in Art Unit 2438 - Cryptography and Security. Fish & Richardson handle the prosecution of the given patent. As demonstrated by Unified’s Law Firm Prosection Tool (LPIX), Fish & Richardson is one the top performing law firms in this art unit in terms of allowance rate, pendency, and breadth of allowed claims (which was measured using Unified’s Broadness Index “BRIX”) . This would mean that in general, Fish & Richardson on average gets more patents granted, at higher speed, and is typically broader than the average application. Other notable performers include Hamilton Desanctis & Cha; Oblon, McClelland, Maier & Neustadt; Haynes & Boone; and Moore and Van Allen.

Unified’s Portal not only shows the top-5 performing law firms for a given art unit, but also includes the top-100 based on LPIX.

Additionally, Unified’s Portal includes an interactive graph that allows users to customize their selection based on factors such as Pendency or BRIX.

Not only can performance be determined on an individual art basis, but by selecting all the Art Units that cover Cryptography and Security, companies can select counsel using these metrics. By looking at the individual art unit, companies can see how challenging a respective unit is. Art Unit 2491 would be one of the hardest as it has an allowance rate of 67.1%, while Art Unit 2497 is considered one of the easier art units with an allowance rate of 84.7%.

Companies can also see, as a whole, how individual law firms fare in this grouping of Art Units. Again, Fish & Richardson is one of the top performing law firms on a consistent basis.

With the increased focus on blockchain and the technology surrounding it, Unified wanted to provide a way that companies can use real-time data to increase not only the quality of their portfolio but also their own efficiencies when it comes to selecting a law firm for patent prosecution. LPIX is able to cut through that noise using relevant criteria--- companies can now select the right law firm when it comes to patent prosecution. This in turn can bolster a company’s position in the quickly growing blockchain industry.

Appendix

Keywords Used: blockchain transaction database, block chain transaction database, blockchains, block chain database, permissionless blockchain, blockchain database, types of blockchain, blockchain game, sidechain ledger, applications of blockchain, blockchain technology, hybrid blockchains, draft hybrid blockchain, nakamoto consensus, permissioned blockchain, industrial blockchain, "51" percent attack, blockchain rollback attack, product tracing, genesis blockchain, data structure blockchain, stock token, digital currency, ledger, non fungible token, distributed ledger, central bank digital currency, ripple payment protocol, decentralized finance, cryptocurrency, decentralized autonomous organization, digital asset holdings, uniswap, smart contract, hashgraph, cryptocurrency exchange, and cryptocurrency wallet.

Law Firm Prosecution Index (LPIX): Moneyball for Patent Prosecution

Sports have long used efficiency ratings to analyze players. Made famous by the movie “Moneyball”, Oakland A’s general manager at the time, Billy Beane, used data-driven tactics to form and operate the baseball team. Unified Patents examined this approach in depth and found that there were no current solutions that could effectively, efficiently, and consistently rate law firms during patent prosecution on both an overall approach and per art unit approach.

Unified started from the premise of “Which law firms do a better job getting the (1) broadest and (2) most valid claims (3) allowed and at a (4) cheaper rate & at a (5) faster rate?" With this premise, three factors stood out to answer this question. The first being our Broadness Index (BRIX), the second being total applications, and finally pendency.

On a basic level, LPIX is the Normalized Value of (BRIX * Pendency * Total Applications^2). The formula squares the Total Applications factor to account for consistency. The comparison with the movie reference here would be at the bottom of the ninth, tied scored, two outs with bases loaded, do you want the player that maybe, one out of hundred times can hit the grand slam, or do you want the player that consistently gets on base giving the team a win? Using that same principle and applying it to patent prosecution, a client would want a firm that they know can consistently prosecute and file a high-quality patent each and every time.

LPIX currently consists of 3,153 law firms in their respective art units. Our coverage spans over 3 million office actions and 1 .7 million patents granted since 2008. It currently utilizes the Office Action Bulk Data set from the USPTO.

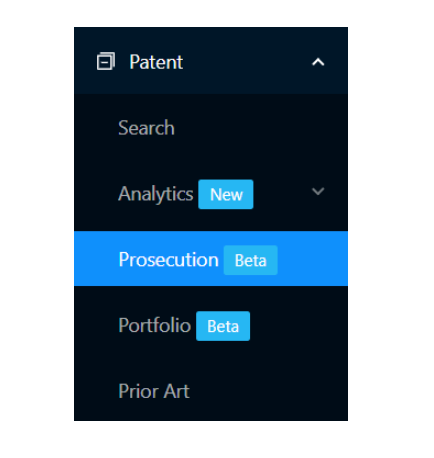

Portal now integrates this data and can show the overall scores of law firms, per unit basis, and also a combination of art units. Click on Prosecution under the Patent filter on the left in Portal:

The first table on the left shows the Top 20 Art Units in terms of Allowance Rate, while the middle shows the Top 20 Examiners in terms of Allowance. The third table on the right shows the Top 20 Law Firms sorted by LPIX. A user can also sort by Allowance Rate for the Law Firms as well.

By entering an Art Unit number, a user now can see the overall scores for that Art Unit. Below is an example where we typed “2872” and can see the scores and rankings for that particular art unit.

This analysis can be taken a step further by clicking on the individual Art Unit.

LPIX is divided into four quadrants. The green represents areas where a law firm is successful, as opposed to the red area where this represents law firms that were unsuccessful. In other words, the top right represents firms that are effective, efficient and consistent. The lop left would be the opposite in which firms are ineffective, inefficient, and inconsistent. The gray area represents law firms that may, for instance, be able to obtain broad patents in a faster time but are below the average in BRIX. Whereas the upper left, may be due to a longer pendency than average.

Here, the Y-axis represents BRIX, the X-axis represents the pendency to grant. The Z-axis, or the circle diameter, represents the total amount of applications.

The purpose of this graph is to show law firms that are efficient, effective, and consistent. This also allows companies to select law firms on their own criteria.

Users have the capability to analyze art units in a combined area. Our example below looks at air units 2871-2879:

LPIX is the only tool that accounts for both subjective and objective factors in measuring a law firm’s ability to achieve success during patent prosecution. Companies now have the ability to understand a law firm’s success in a given art unit, while being able to set their own patent strategy.

For more information about LPIX, please visit our support page.

Unified Urges Federal Circuit to Reverse Western District's Prejudged Blanket Rule Denying Contested Stay Motions

On April 26, 2021, Unified, along with The Computer & Communications Industry Association (CCIA) and CableLabs, filed an amicus brief in re Vulcan Industrial Holdings, a petition for mandamus of a denial of a stay by Judge Albright in light of an instituted PGR (PGR2020-00065). In the brief, amicus argued Judge Albright has clearly abused his discretion by openly adopting a rule against stays that "smacks of prejudgment." Here, Vulcan diligently filed a PGR two and a half months after the patent grant and just one and a half months after the complaint was filed, but the Court found even that aggressively early filing was dilatory, ignored the certain simplification of issues that the USPTO instituted on all claims, and applied an erroneous legal test despite clear guidance from the Federal Circuit and myriad district court rulings.

A copy of Unified’s amicus brief is provided below.

Unified Portal launches AI-based prior art searching for US patents

Unified is happy to announce a new feature to quickly find prior art on US patents with our Portal tool. Through a partnership with PQAI, a researcher will receive the most relevant prior-art results to determine the novelty and obviousness of the patent in question. Unified Portal offers three ways of searching for prior art:

In our patent detail page next to the patent title, there is a button labeled "Find Prior Art". Clicking this button will provide our user with a list of potential prior art patents to review. These results will be shown in Portal’s patent search page with its corresponding query string.

Reading through the patent within Portal’s patent detail page will also give our users an opportunity to search for prior art on a specific claim they would like to research further:

The third way of searching for prior art within Portal is to search by natural language here: https://portal.unifiedpatents.com/patents/prior-art/pqai

If results are found, up to 10 results are produced to help researchers and inventors determine the novelty of their inventions. For more details or to ask questions, please email info@unifiedpatents.com.