Non-practicing entity (NPE) litigation against semiconductor companies—particularly analog chips—has grown significantly in the past few years, as their value in all types of products has increased. And while much attention is given in the semiconductor industry to CPUs and GPUs (which handle the most complex tasks), NPEs have increasingly focused on analog chips, which Unified classified as low-power or high-power audio or radio frequency applications that support many functions. With easier (and broader) infringement profiles and a proliferation of patents available on the open market, it’s no surprise that the NPE industry has shifted their attention to the more easily-enforceable (and more likely invalid) analog sector.

Over the last year, semiconductor and supply chain shortages have made headlines. Both have led to inflation and raised concerns about economic corrections. Chip shortages have been blamed for many of the supply chain issues, as they are necessary for so many different products now, from lightbulbs to automobiles. Though most would assume complex chips drive the shortages, in truth many of the supply chain issues are the result of analog chips. That, coupled with the relative ease of proving infringement and the ready availability of patents to license, has led NPEs to focus more resources on asserting against the analog industry.

For instance, Atlantic IP, a Magnetar Capital-funded managing entity based in Ireland, has several subsidiaries currently engaging in high-stakes funded litigation. Neodron, Scramoge Technology, Sonraí Memory, Arigna, and Solas (to name a few of their ongoing campaigns) currently have nearly 3,000 assets to their name, and started asserting them in various high-profile litigation campaigns.

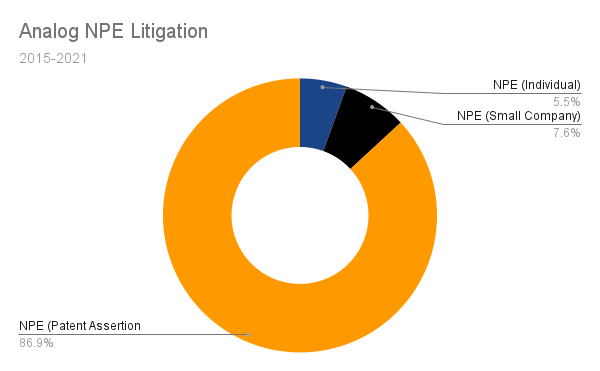

Indeed, nearly 87% of all recent analog semiconductor litigation has come from PAEs.

The explosive growth of patent aggregators has led directly to the explosion of suits. Indeed, nearly 40% of all of this litigation is driven from larger aggregators like Atlantic IP.

What’s more, over 36% of these aggregators have third-party financing supporting their assertions.

To put this issue in perspective, the top-20 plaintiffs—the frequent filers and notorious aggregators—account for nearly 60% of all analog semiconductor cases.

That said, there are a surprising number of smaller campaigns being filed against analog chips, cases both big and small in licensing target—some from file-and-settle nuisance NPEs like IP Edge, others from slightly more serious lawyer-run entities looking for a quick payday with a 101-resistant portfolio. Either way, it appears that investors and assertors alike see much value in assertions in the analog semiconductor space.

Copyright © 2022, Unified Patents, LLC. All rights reserved.