Leading Economic Expert finds that PTAB challenges lower total costs and benefit the US Economy almost $2 billion regardless of whether litigation stays are granted

The Perryman Group, in a recent economic study commissioned by Unified, found substantial cost savings in district court cases when there is a copending IPR proceeding regardless of whether a stay is granted or not.

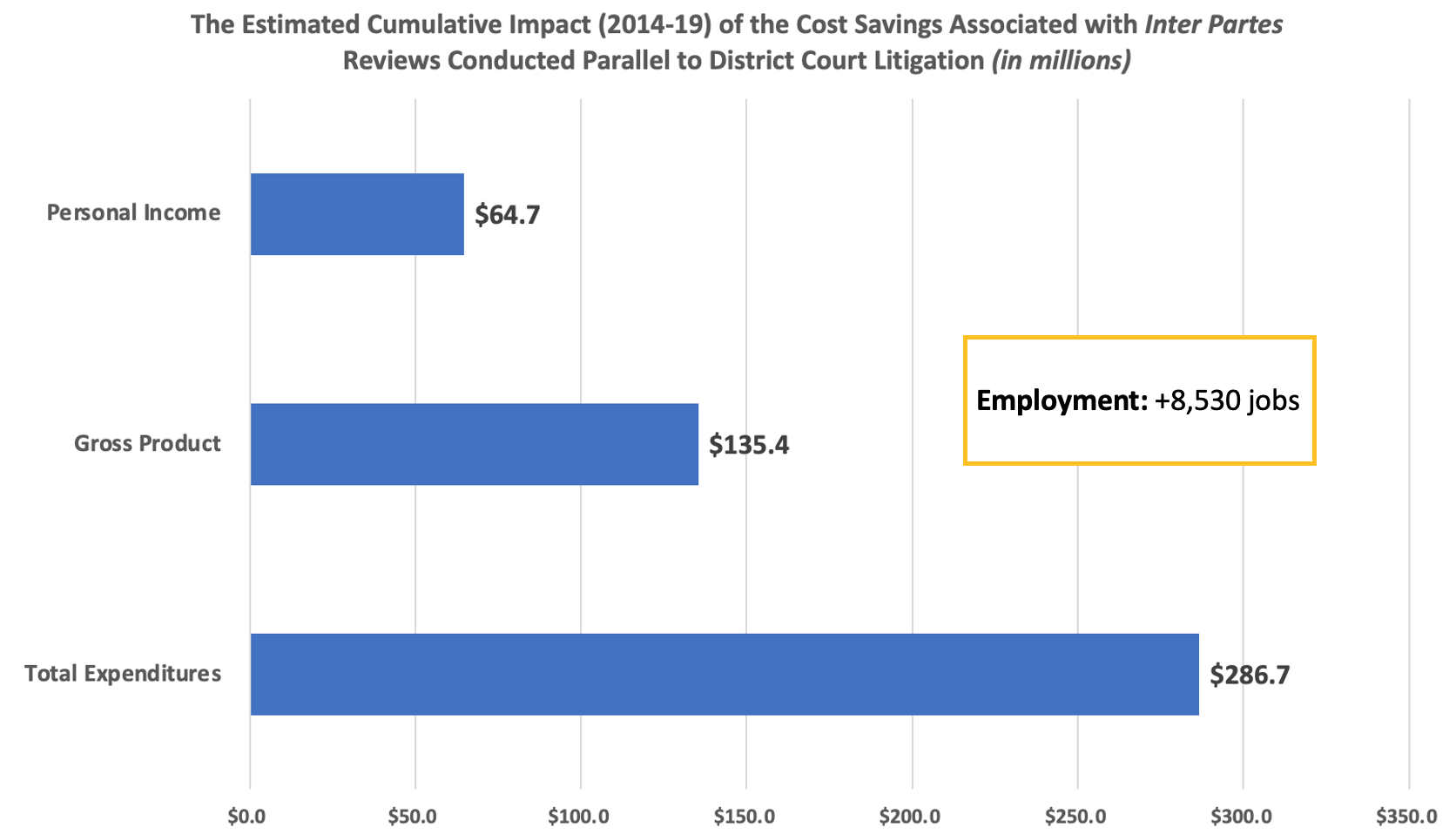

The study found either outcome resulted in substantial benefits to the U.S. economy by improving business activity $1.87 billion and saving 8,530 job years. That included where an IPR was conducted parallel to an ongoing district court proceeding, where the Perryman Group estimated the economic benefits of cost savings over the 2014-19 period of $135.4 million in US gross product and 617 person-years of employment. The study also found these benefits are primarily concentrated in the manufacturing sector.

Source: The Perryman Group

The full study is available here, and complements Perryman Group’s earlier work demonstrating the quantifiable economic benefits of the Leahy-Smith America Invents Act’s post-grant proceedings in the years following their implementation.

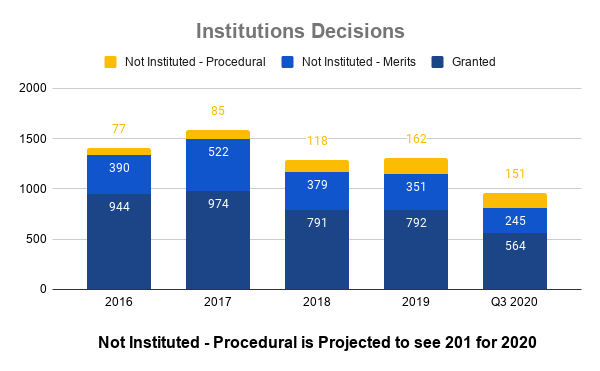

Source: The Perryman Group

The Perryman Report is part of Unified Patents’ Patent Quality Initiative (PQI), an effort to gather and provide objective data and research demonstrating how lowering patent quality will inevitably lead to even higher cost and risk for U.S. SMEs, inventors, and manufacturers, and can lead to less innovation, fewer U.S. jobs, and a drain on the U.S. economy. Our PQI aims to provide data, studies, and testimonials to give policymakers and practitioners a clear picture of the state of the patent system. More information about our PQI efforts can be found here.

For far greater detail, read the entire report HERE.

Copyright © 2021, Unified Patents, LLC. All rights reserved.